In today’s dynamic business environment, organisations must identify and capitalise on market opportunities to succeed. Market opportunities can refer to favourable circumstances that allow a company to introduce a new product to an existing market or enter a new market, potentially generating significant profits. It can also refer to the current or potential benefits a geographic area offers to businesses that operate within it. However, identifying market opportunities can be challenging, as it requires a deep understanding of customer needs, market trends, and the competitive landscape.

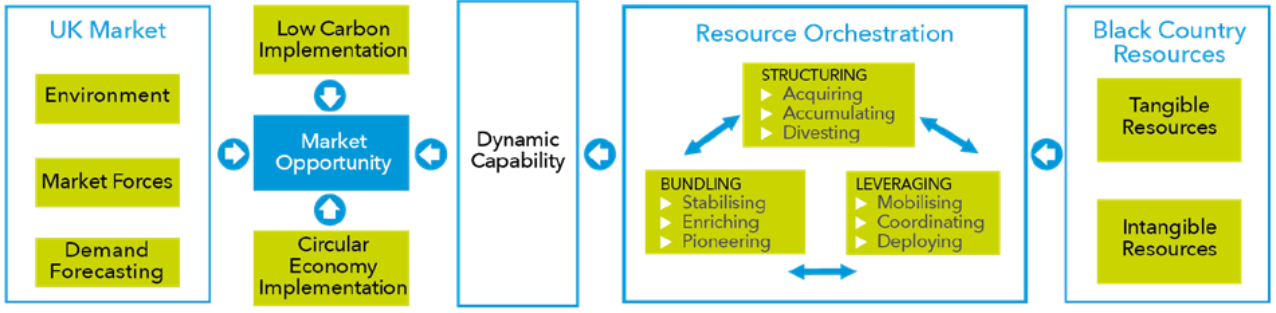

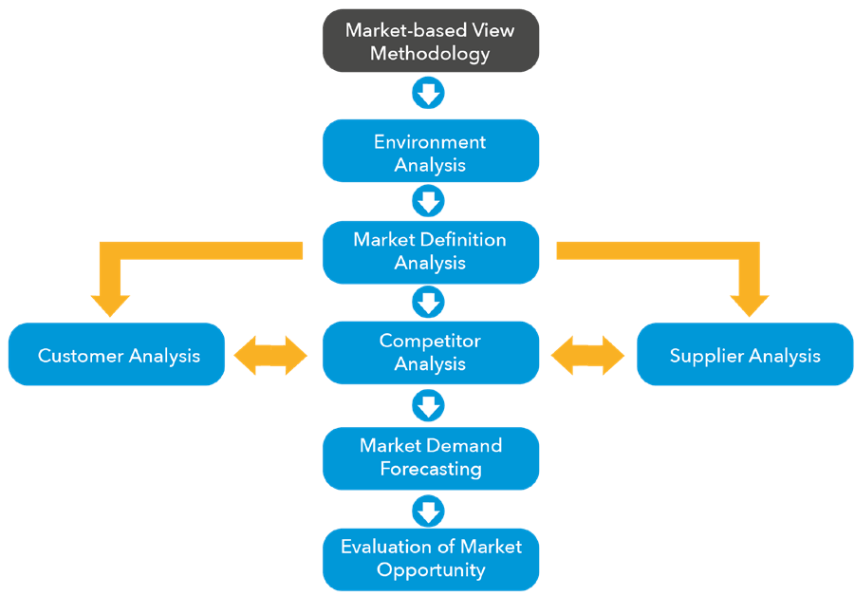

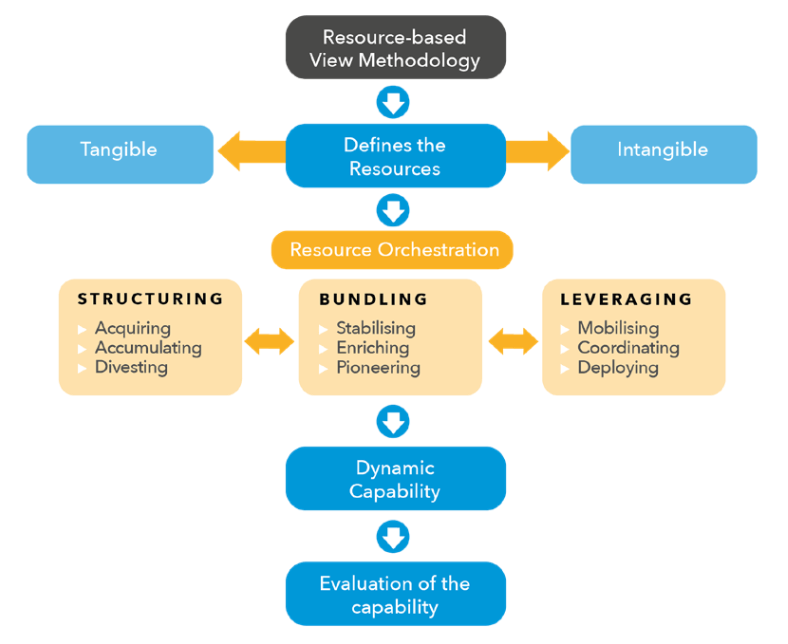

To overcome these challenges, businesses and regions can use various methodologies to analyse and evaluate potential market opportunities. These methodologies help them identify gaps in the market, assess the feasibility of new products or services, and determine their capabilities. Market and resources-based opportunity analysis methodology is one such approach that uses a structured approach to provide a comprehensive understanding of market opportunity from both top-down and bottom-up directions. This equips companies and regions with the knowledge to make informed strategic decisions for the future.

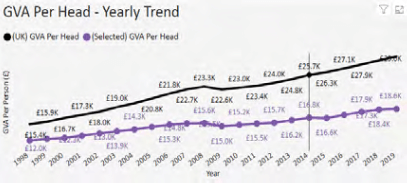

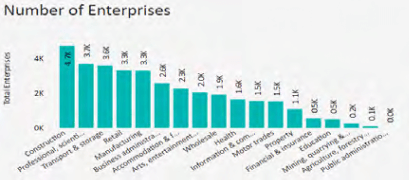

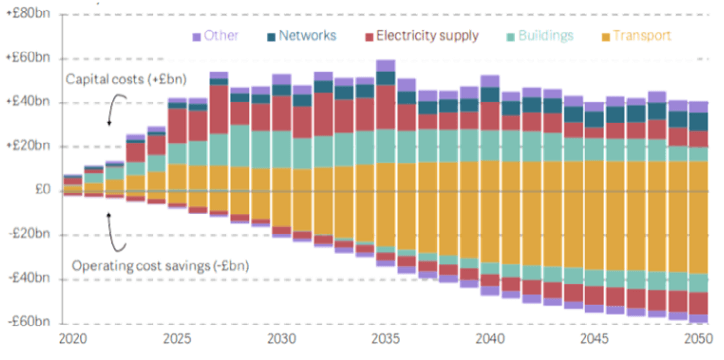

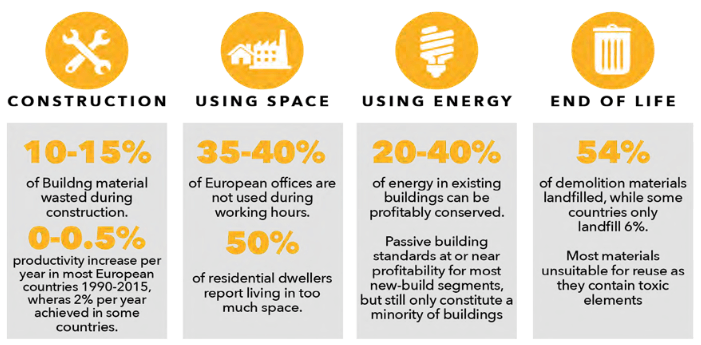

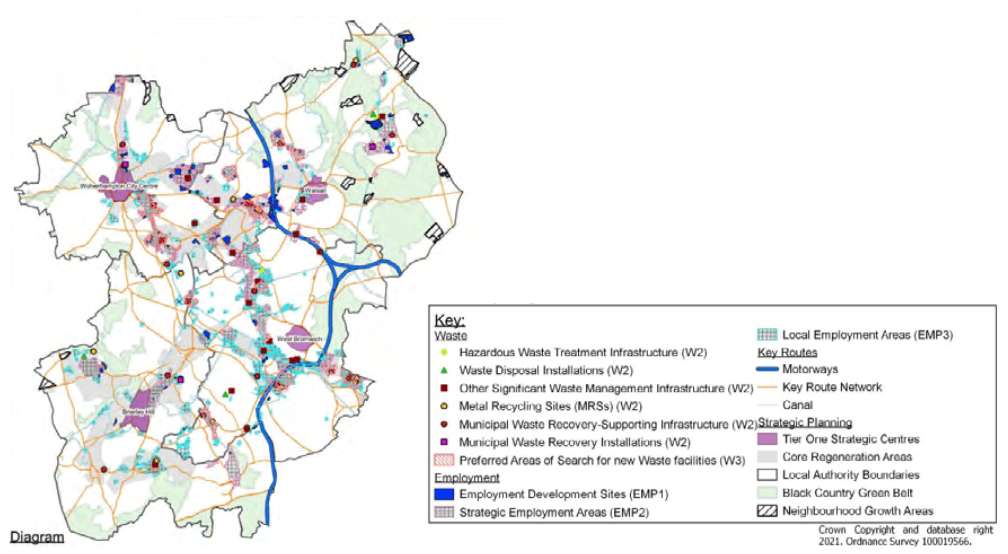

The Black Country (BC) region is a data-driven case study in this report. The region is focusing on low-carbon and circular economy opportunities in particular. This report as part of the deliverables from the project Repowering the Black Country, is co-developed with Loughborough Business School. It highlights four primary and four secondary sectors with future sustainability market opportunities. For businesses, a market opportunity methodology is a systematic approach that enables them to make informed decisions about market entry, product development, and business expansion. For regions, a rigorous market opportunity methodology can help them attract new businesses, create new jobs, allocate limited funds, and map out future regional development strategies.